alabama tax lien laws

Division 1 Agisters or Trainers. To defeat owner must object to services or materials.

Free Arkansas Bill Of Sale Form Pdf Template Legaltemplates With Regard To Car Bill Of Sale Word Templ Bill Of Sale Template Word Template Invoice Template

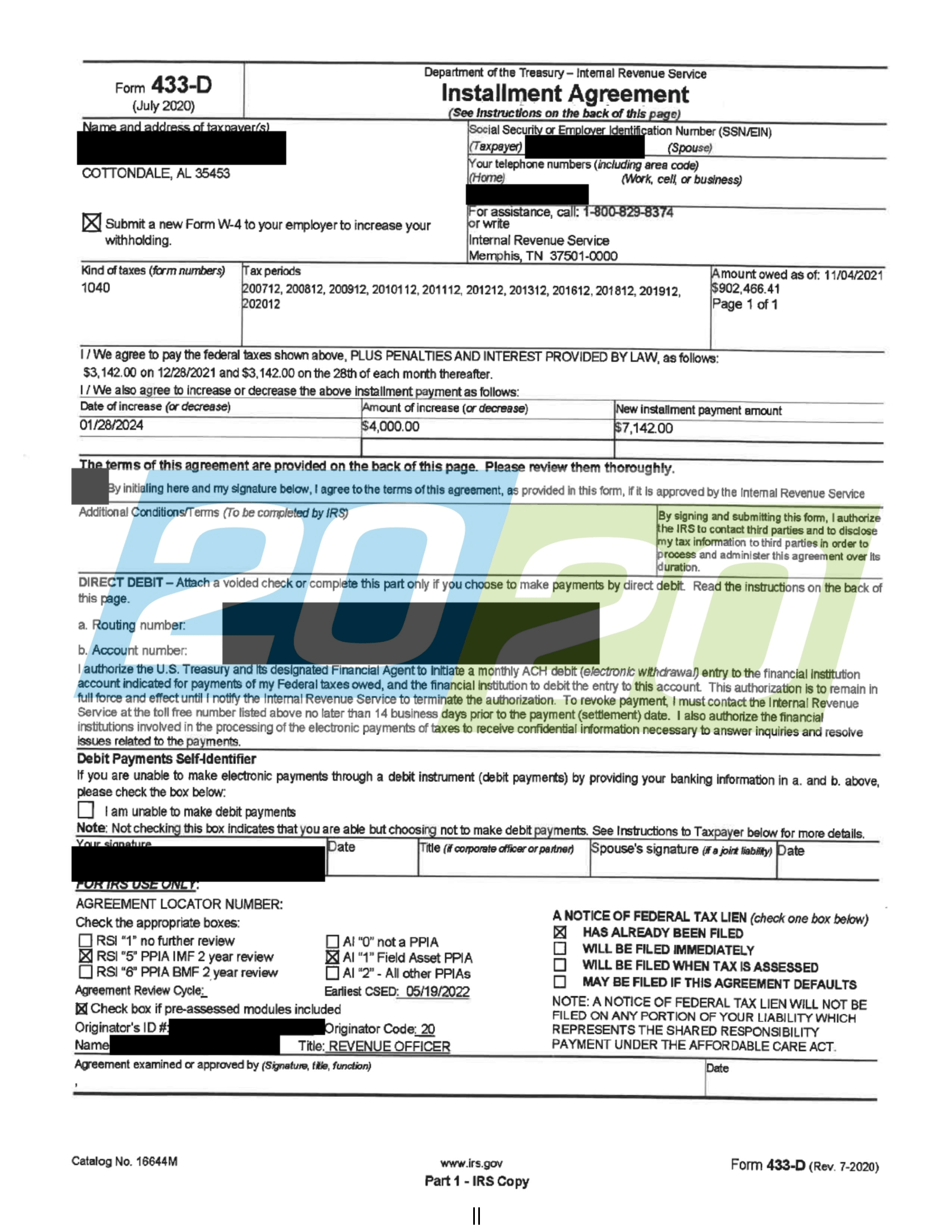

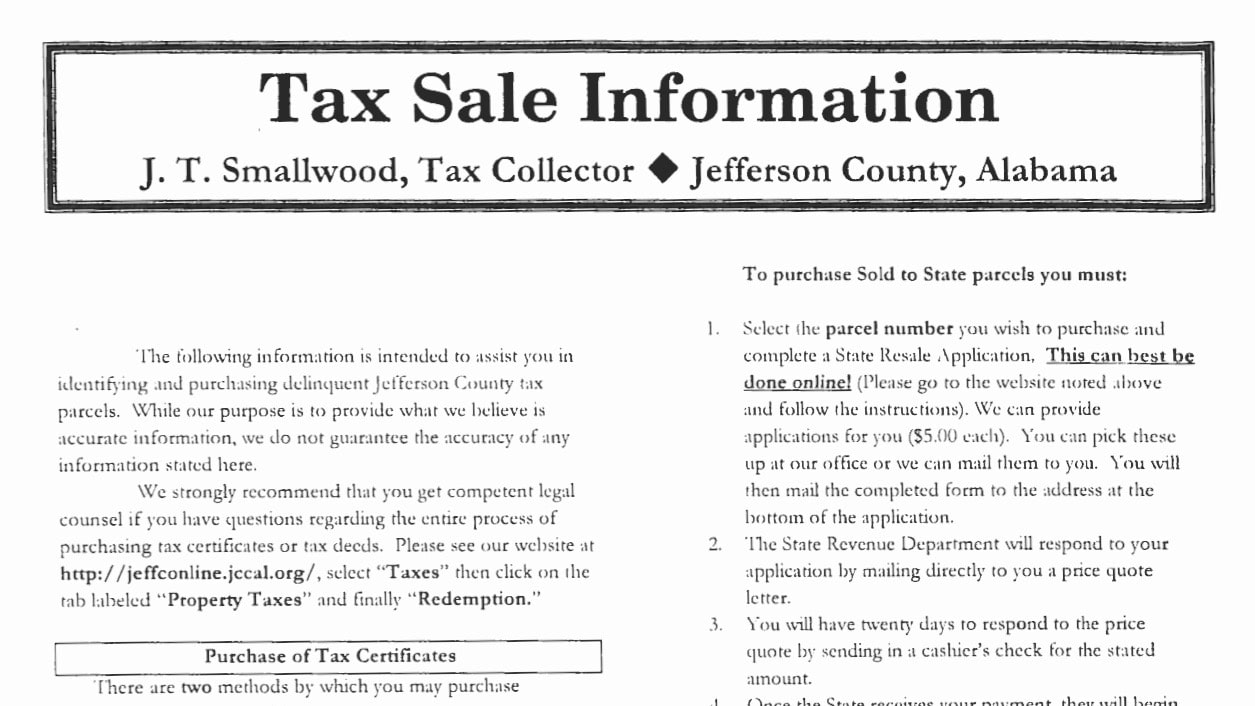

Alabama tax lien certificates are sold at County Tax Sales during the month of May each year.

. Income Taxes Business Privilege Tax. Act 2018-577 signed by Gov. Non-Judicial Judicial and a new judicial foreclosure hybrid the tax-lien-certificate judicial foreclosure.

In alabama taxes are due on october 1 and become delinquent on january 1. Up to 25 cash back In Alabama if the state buys the tax lien the property may be redeemed at any time before the title passes out of the state. Check your Alabama tax liens rules.

Alabama is known as a non-judicial foreclosure state. C A tax lien certificate shall bear the interest rate per annum as bid on by the purchaser at the tax lien auction or as agreed upon by. Ad Affordable Reliable.

Tax liens subject to public auction or sale. In order to avoid paying sales tax if the public entity fails to pay the suppliers may bring a claim on the payment bond. A All tax liens representing unpaid and delinquent taxes on real property shall be subject to a tax lien.

Alabamas Mechanics Lien Statute is codified in Ala. The foreclosure sale may be postponed by the sheriff from day to day. It is advisable to consult a competent attorney regarding your contemplated purchase of tax delinquent property.

Who May Have A Lien. Section 35-11-60 - Lien declared. For purposes of this article the following words and phrases shall have the respective meanings ascribed by this section.

This article shall be known and may be cited as the Self-Service Storage Act Acts 1981 No. The lien imposed by Section 40-29-20 shall not be valid as against any purchaser holder of a security interest mechanics lienor or judgment lien creditor until notice thereof which meets the requirements of subsection f has been filed by the Commissioner of Revenue or. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

Up to 25 cash back Alabama Tax Lien Sales. If there is no bidder the State of Alabama buys the land at the amount of the tax lien. Section 35-11-70 - Lien on stock for pasturage or training.

Financial Institutions Excise Tax. In Alabama the lenders can also go to court in what is known as a judicial foreclosure proceeding where the court must issue a final judgment of foreclosure. Section 35-11-72 - Lien of landlord on stock raised on rented premises.

The purchaser of the tax liens obtains the right to collect all delinquent taxes penalties interest and costs with respect to the property. Income Taxes Corporate Income Tax. Lien for full amount of materials regardless of whether value of materials exceeds unpaid balance due by owner to general contractor.

B A tax lien certificate shall evidence the auction or sale or assignment to the holder of the tax lien certificate of the delinquent and unpaid taxes penalties interest fees and costs set forth therein and represented by the tax lien. The winning bidder at an Alabama tax sale is the bidder with the greatest bid. Section 40-10-142 Lien and sale of property for unpaid installments of taxes - Disposition of money.

A the tax collector shall make execute and deliver a tax lien certificate to each purchaser at the tax lien sale or to each assignee thereafter and shall collect from the purchaser or assignee a fee of one dollar 1 for each tax lien certificate. Auction or a tax lien sale. Some counties pay interest on both the minimum and premium bid amounts.

The probate court must sell the property at the tax sale for at least the amount of the tax lien ie the amount of Taxes owed plus late fees and any other fees due. Additional information can be found in the Code of Alabama 1975 Title 40 Chapter 10 Sale of Land. Section 40-10-141 Lien and sale of property for unpaid installments of taxes - Procedure.

It does not apply to judgment liens vendors lien. Alabama State Lien Law Summary. Trusted Methods Excellent Tax Team.

Article 6 Refund of Taxes Paid by Mistake or Error. HB 354 would revise the tax lien sale procedures for counties to authorize tax liens to be sold. The Alabama Senate has a companion Bill SB261 that is waiting on the call of the chair to bring the Bill to a vote.

The bidding begins at just the back taxes owed. Tax liens offer many opportunities for you to earn above average returns on your investment dollars. Again if you dont pay your property taxes in Alabama the delinquent amount becomes a lien on your home.

However that designation only applies to consensual liens. Section 40-10-143 Lien of persons other than holders of legal title for expenses of redemption. Alabama Tax Lien Certificates.

Once there is a tax lien on your home the taxing authority may hold a tax lien sale. Alabama Business Privilege and Corporation Shares Tax of 1999. Search Tax Delinquent Properties.

Alabama law grants redemption rights to all persons or entities having an ownership interest in the property or who hold a mortgage or lien on the property at the time of the tax sale20 Alabama. Alabama Lien Law Section 8-15-30 Short title. On March 8th 2018 the Alabama House of Representatives unanimously passed HB354 that MAY drastically change tax lien laws in your COUNTY.

CHAPTER 10 SALE OF LAND. Sales usually occur between 11AM and 4PM. Article 5 Liens of Particular Persons or Classes of Persons.

There are now three broad categories of foreclosure in Alabama. 1321 1 Section 8-15-31 Definitions. A Purchasers holders of security interests mechanics lienors and judgment lien creditors.

Tax liens are purchased with a 3 year redemption period and a 12 percent annual rate of return or 1 percent per month. If you do not see a tax lien in Alabama AL or property that suits you at this time subscribe to our email alerts and we will update you as new Alabama. The reason I capitalized MAY COUNTY will be evident when.

Seq and is reproduced below. Alabama is a tax lien certificate state but also offers tax deed properties in select counties. Section 40-5-47 Collection of ad valorem tax revenues earmarked for support of fire protectionand emergency services.

Neither an assignment nor a tax deed gives the holder clear title to the parcel. In Alabama taxes are due on October 1 and become delinquent on January 1. B1 The tax collecting official of any county shall conduct a.

Updated as of March 2021. If another party buys the lien you may redeem the property at any time within three years from the date of the sale. Under existing law counties have the option to sell their outstanding tax liens on real property.

AL Code 40-10-187 2016 Section 40-10-187 Tax lien certificate. Get Your Options Today. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

The property is then sold as part of a publicly noticed sale by the sheriff. Newman Bros Inc 288 So2d 749 CtAppAla. The original owner has 3 three years to redeem his or her interest in the property.

See Alabama Code 1-1-1. Dont Let that Lien Hold Back Your Financial Future. Code 40-10-120 40-10-29 Ala.

Just remember each state has its own bidding process. Section 40-5-44 Final settlements and payments by collectors. Section 40-5-45 Mileage to and from seat of government.

Section 35-11-71 - Lien on birds or animals for feeding boarding or training. Section 40-5-46 Lien of tax collector. The majority of the counties.

2018 Alabama Tax Lien law changes. A The tax collector shall make execute and deliver a tax lien certificate to each purchaser at the tax lien sale or to each assignee thereafter and shall collect from the purchaser or assignee a fee of one dollar 1 for each tax lien certificate. When you perform work on a private construction project in Alabama and are not paid you can file a lien against the project pursuant to Alabamas Mechanics Lien Statute.

Ad Find The Best Deals In Your Area Free Course Shows How.

Alabama Tax Sales Everything You Need To Know Youtube

Is Alabama A Tax Lien Or Tax Deed State And What Is The Difference Between A Tax Lien And A Tax Deed Tax Lien Certificates And Tax Deed Authority Ted Thomas

Alabama Tax Sales Tax Liens Youtube

Is Alabama A Tax Lien Or Tax Deed State And What Is The Difference Between A Tax Lien And A Tax Deed Tax Lien Certificates And Tax Deed Authority Ted Thomas

Tax Notice Error Causes Homeowners To Fear Eviction Wbma

Alabama Tax Sales Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

Tax Liabilities Solved In Alabama 20 20 Tax Resolution

Faq Alabama Tax Sale Investing Youtube

Late Paying Your Property Tax Investors See An Opportunity Wbhm 90 3